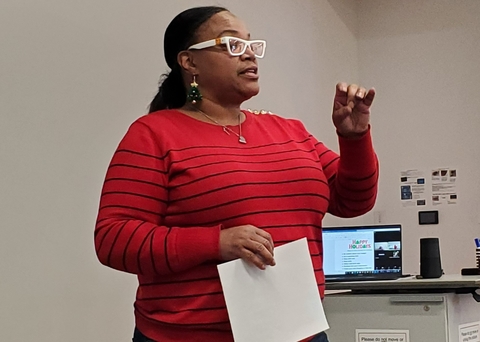

For Tonia Brinston, it’s not just about numbers; it's about people.

April is National Financial Capability Month. Tonia Brinston says financial education isn’t just a part of her work; it’s intrinsically linked to her life journey.

“I was a poor single mother on welfare,” Brinston says. “Growing up, almost everyone in my family was on government assistance. I was under the impression that that was just the way of life. But I wanted more for myself.”

Brinston, a financial health and wellness coordinator for University of Minnesota Extension, has a unique responsibility. “At Extension, I have dual roles: SNAP-Ed* and financial capability. I live and work in north Minneapolis, and Extension allows me to be instrumental in bringing financial education to my community while also sharing my nutrition and culinary knowledge.”

Brinston is based at the University's Robert J. Jones Urban Research and Outreach-Engagement Center.

Understanding financial trauma

It isn’t uncommon for Brinston to help community members in north Minneapolis combat and overcome various obstacles — financial trauma is a big one.

“Financial trauma is an emotional and psychological response to financial adversities, whether it’s living paycheck to paycheck, loss of income, divorce," says Brinston. "It shows up in various ways. And I think the culture one lives in plays a role in that.”

There are several ways one can overcome financial trauma. In Brinston’s experience, owning a home goes a long way. And buying her first home was a key motivator in how she overcame her own financial struggles as a poor single mother.

“Home ownership is the gateway to building generational wealth," she says. "Owning a home was a goal I set for myself early on. And to achieve that goal I had to be real with myself. I had to downsize. I turned into a minimalist, big time! For example, instead of going to happy hour every pay period or buying a new outfit every weekend, I started paying that money towards my debt.”

Saving and planning for the future

Managing debt is an important first step toward achieving financial stability, but often it can be difficult to know where to start. While strategies matter, Brinston explains that starting with a conscious commitment to saving money is what’s most important. It’s all about the mindset.

“There are so many different ways of saving, but the most important thing to understand about it is that it’s a mindset change," she says. "You have to want to do it, you have to know how to do it. You have to have the right support. And you have to have commitment and dedication to track every single one of your expenses. Give every penny a job.”

Keep it simple

Over the years, Brinston consulted various financial planners for advice. Those consultations ended up informing the way she approaches financial education.

“I appreciate my current financial planner because the previous ones I’ve worked with were so ‘over the top’ with the language they used; they didn’t speak in layman’s terms. They didn’t level the playing field for the average person like me. Financial education should be person-centered. It can’t just be numbers and processes. We’re talking about people’s lives.”

At the end of the day, succeeding in any aspect of life goes back to one thing for Brinston: perseverance.

“It doesn’t matter how many darts you throw at me; I’m going to dodge and pivot. And that’s been my life story.”

*Supplemental Nutrition Assistance Program Education

Permission is granted to news media to republish our news articles with credit to University of Minnesota Extension. Images also may be republished; please check for specific photographer credits or limited use restrictions in the photo title.